THE GIST

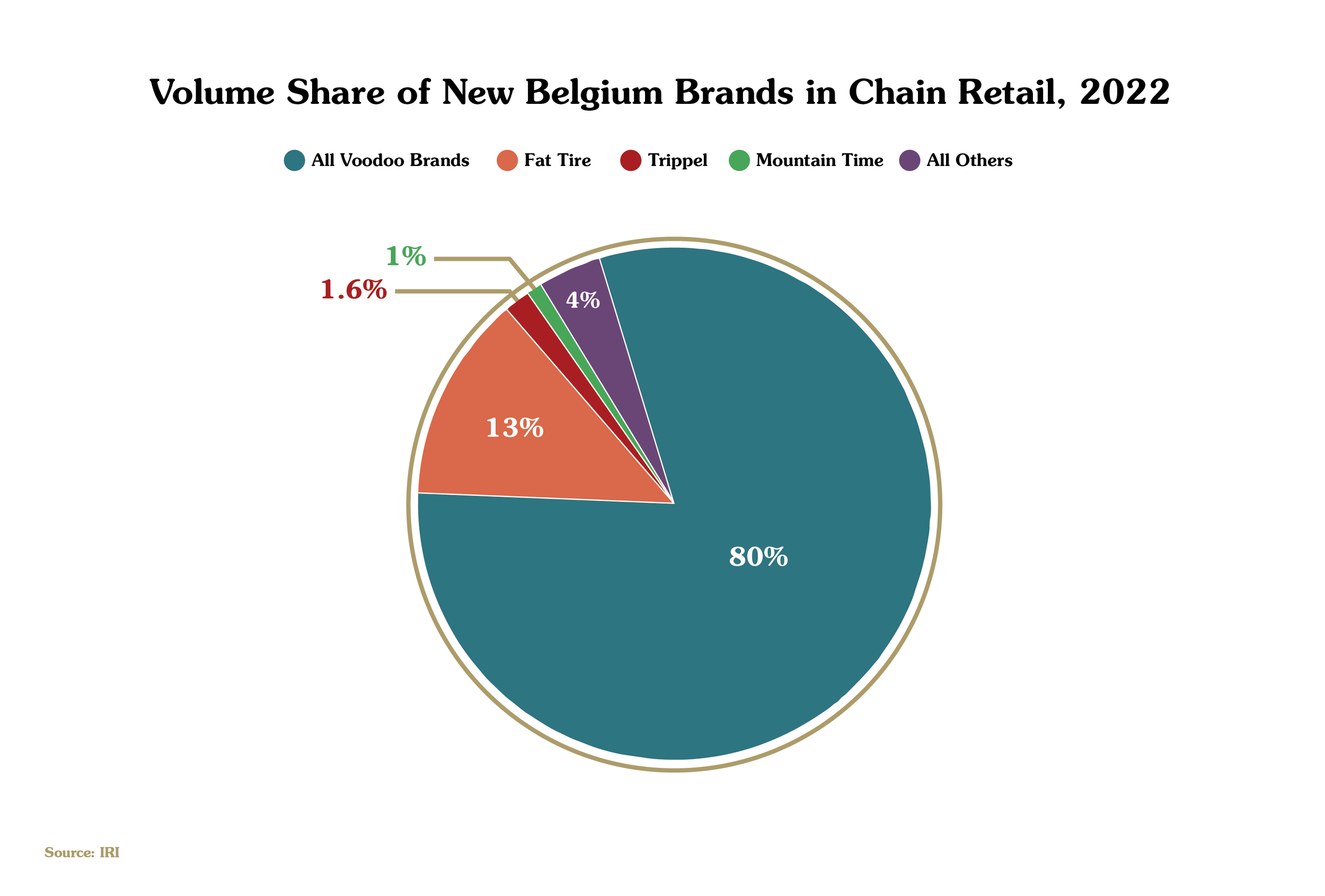

It’s a bones day at New Belgium Brewing. The Kirin-owned company announced it will purchase a 295,000-square foot facility in Virginia to keep up with increasing demand for its Voodoo Ranger line of IPAs. That brand family—which includes IPA, Imperial IPA, Juice Force Hazy Imperial IPA, and others—constitutes 83% of New Belgium’s chain retail beer sales volume year-to-date, as tracked by market research firm Circana (formerly IRI), up from 80% in 2022. Voodoo Ranger Imperial IPA is the top-selling IPA in U.S. chain retail, per Nielsen data, while Juice Force debuted as the biggest craft launch ever in 2022.

It’s a rich-get-richer kind of move for New Belgium, which in recent years has become a standard bearer for nationally-distributed craft beer. The company has increased overall production four consecutive years, which includes surpassing 1 million barrels in 2021. The facility will help the business continue its upward trajectory at a time when craft beer growth has stalled.

The Daleville, Virginia facility currently belongs to Constellation Brands, which built it for $48 million in 2016 to brew beers from Ballast Point, a brand it owned until a 2019 sale to Kings & Convicts Brewing. New Belgium says the purchase will add 125,000 barrels of capacity as its existing brewhouses in Fort Collins, Colorado and Asheville, North Carolina are nearing maximum output. This news was first reported by Brewbound, and financial terms were not disclosed.

Critically, this second East Coast outpost for New Belgium can produce not only Voodoo Ranger and other beers, but also flavored malt beverages (FMBs) and spirits-based, ready-to-drink (RTD) canned cocktails. In a press release, New Belgium says it will “explore ways to leverage the facility’s FMB, seltzer, and RTD capabilities.” Non-beer products have been an increasing area of focus for New Belgium:

This month the company launched an FMB called Wild Nectar Hard Juice and is reportedly considering a hard tea expansion under the Voodoo brand.

The company had previously launched its Fruit Smash line of hard seltzers in 2021. Last year, Fruit Smash sold 25,350 barrels in chain retail, twice as much as New Belgium’s Trippel, its third best-selling beer, and has expanded with an 8% ABV “Super Hard Seltzer.”

While FMBs offer potential for the future, adding the Virginia facility illustrates how intertwined New Belgium’s overall health is with the current success of Voodoo Ranger, a brand that needs to maximize sales while it’s still bucking the overall beer category’s sluggish trends. Beer was -4.1% in chain retail sales volume last year while craft declined -7.7%. The collection of all Voodoo-branded beers increased +26.5% in volume.

In a press release, New Belgium CEO Steve Feichheimer alluded to difficulty keeping up with demand for Voodoo Ranger, stating: “For a company growing as fast as New Belgium, there’s no challenge more urgent than boosting our ability to make enough beer to meet growing demand. … We greatly appreciate the partnership we’ve seen from distributors and retailers over the past several months as we’ve worked to find a solution.”

WHY IT MATTERS

Now is the time for New Belgium to make hay while the sun shines.

Voodoo Ranger has become the most important national craft beer brand over the past five years, with the total Voodoo Ranger lineup selling 657,798 barrels in chain retail last year, per Circana data. That’s just 2.5% less than the all volume sold of Blue Moon Belgian White during the same period.

Newcomer Voodoo Ranger Juice Force Hazy Imperial IPA, which launched in March 2022, is the number-two beer in New Belgium’s portfolio.

Juice Force is now tag-teaming with Voodoo Ranger Fruit Force IPA, a fruit punch-flavored sequel that launched in January and has already sold 100,000 case equivalents through March 12, just ahead of Wicked Weed Pernicious IPA and Golden Road Mango Cart, two of the largest craft brands owned by Anheuser-Busch InBev.

Outside of anything that doesn’t feature a skeleton, it’s a mixed bag. Flagship Fat Tire trails far behind the Voodoo Ranger line and has shed -52% of its volume in chain retail nationally since its peak sales year in 2016. In January, this prompted a complete recipe and branding change for Fat Tire, which is now billed not as an Amber Ale but as “crisp, bright, and easy-drinking.” New Belgium’s Mountain Time Premium Lager (+0.8%) and Dominga Mimosa Sour (+14.6%) both grew in volume in 2022—a rarity for many of their craft peers—but still represent a small portion of New Belgium's overall retail sales. Trippel declined -1.5% and along with Mountain Time and Dominga, accounted for about 8% of the sales volume earned by Voodoo Ranger Imperial IPA last year.

Figures represent New Belgium beer sold in chain retail.

Meanwhile, Constellation Brands, which is selling the Daleville plant to New Belgium, wishes it had a Voodoo Ranger equivalent in its craft portfolio. While it focuses on white-hot Mexican imports such as Modelo, its acquired craft brands languish as afterthoughts. Ballast Point lost sales until it was sold in 2019 for a fraction of its $1 billion purchase price; other Constellation-acquired craft brands continue this lackluster pattern. All of Funky Buddha’s year-round beers posted double-digit sales volume declines in chain retail last year, with flagship Floridian Wheat Beer tumbling -21%. All of Four Corners’ year-round beers saw volume sales decline by at least -33% in 2022.

To be sure, times are tough for craft generally. Speaking in early March at the New England Craft Brew Summit, Brewers Association chief economist Bart Watson said he anticipates overall craft brewery production volume to increase just +0.6% for 2022, marking the second time he has revised that figure downward. The outlook is even more challenging in chain retail, where Watson said craft breweries struggle to stand out on shelves and even in their own distributors’ minds.

“For small distributing brewers, it’s a challenge to gain attention in the distributed marketplace. Distributors and retailers are looking for scale and velocity,” Watson told Good Beer Hunting. “Small start-up brands or brands in niches run counter to what you hear a lot of distributors want.”

Bucking these trends, though, Voodoo Ranger has what distributors want: a high-volume brand with seemingly endless permutations that continue to gain traction with drinkers in grocery stores and convenience stores. Through its purchase of the Virginia production facility, New Belgium slides more of its chips toward Voodoo Ranger—and prepares for whatever non-beer opportunity might be on the horizon.

[Disclosure: New Belgium is a client of Feel Goods Company, Good Beer Hunting's parent company.]