It’s a warm, sticky night under a drizzling rain in Bangkok’s Pak Kret district, but that hasn’t kept a couple hundred beer enthusiasts from coming out to a dead-end alley running through a few swampish grass lots. The setting sounds unlikely, but they’re here for the long-awaited grand opening of a brewing center known as MITR. Food trucks ring the crowd, selling oversized burgers as well as more traditional Thai fare like grilled pork and spicy papaya salad. A live band inside churns out an eclectic racket that penetrates the industrial center’s walls, mixing with the chatter of drinkers huddling under tents and the backing chorus of croaking frogs from the fields that surround it.

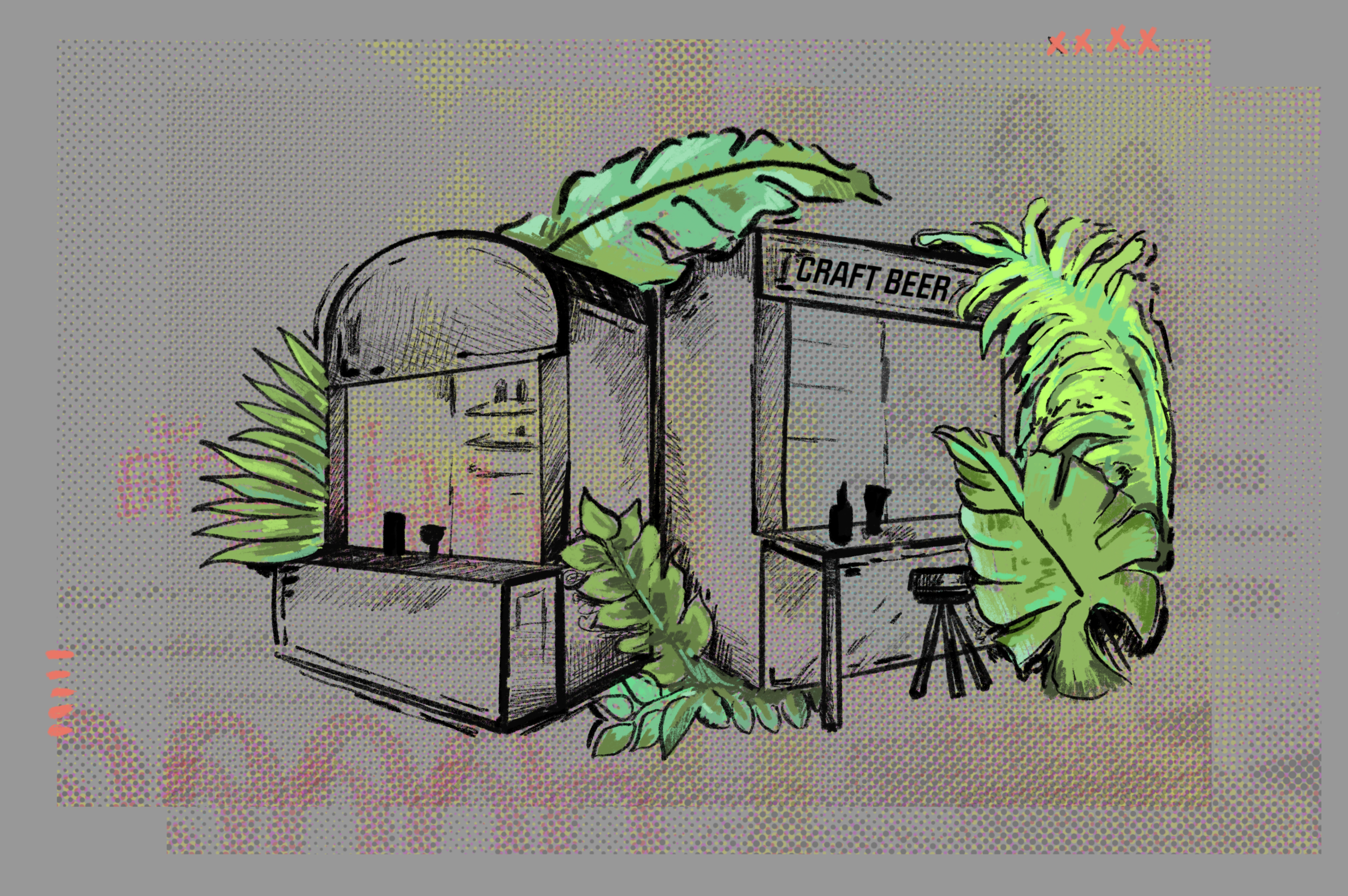

Located in the northern suburb of Thornburi, Pak Kret is known as the hub of the Thai craft beer scene. Most of the people responsible for the burgeoning industry are in attendance at MITR. The hybrid microbrewery/learning center, which also has an on-site bar, is the collective effort of six Thai brewers with support from 44 affiliate brewers ranging from hobbyists to aspiring commercial brewers. MITR is an archaic word in Thai that means friend or friendship, referring not only to the core group that started the center but also as a call out to anyone to come and brew there.

The center’s goal is to legitimize and legalize craft beer in Thailand. It is pushing for changes to government regulations that currently support a national brewing duopoly—literally just two breweries—which has effectively controlled the entire beer market in Thailand since its modern formation in the 1930s.

Due to Thailand’s stringent lockdown to control the COVID-19 outbreak, the center’s opening was delayed for months. By August, though, there had been no new cases reported in the country for two months, so businesses, including bars and restaurants, were given the OK to open fully. Though regulations have been lifted and no one is wearing a mask at the bar, everyone has one at hand for public transportation, stepping into a 7-Eleven, or general walking around in the city. Still, the maskless atmosphere—a rarity in Bangkok even before the pandemic—is one of normalcy and celebration.

Inside, the bar has 12 choices of beer on tap, each made on the premises: two by each of the six core brewers, with the selection changing from week to week. Over the course of the night I go from a clean, lean-tasting Pilsner to a mango-infused IPA to the rich indulgence of a 12% Vanilla Stout that lingers in the mouth like a dessert. Each is miles away from the duopoly’s two very similar Lagers that have dominated the Thai beer market for almost a century.

For most of the almost two decades that I’ve lived in Thailand, the beer selection has been essentially limited to two interchangeable—and in my opinion, equally undrinkable—beers. They are Chang and Singha, each as symbolic of the nation as its white-sand beaches, temples, and spicy cuisine. The brands’ namesakes, the Elephant and Lion, are printed on everything from T-shirts to bumper stickers. To millions of visiting foreigners, they are synonymous with Thai nightlife.

Boon Rawd Brewery, which makes Singha, and ThaiBev, which brews Chang, the country’s best-selling beer, are owned and run by two of the wealthiest families in Thailand. Through longevity and political influence, these two breweries have dominated Thai beer for nearly a century, forcing out or crushing any competition, foreign or domestic.

Until very recently there was no craft beer market in the country at all. That left a handful of imported beers, like Guinness or Paulaner, as the only alternatives to the mass-market, domestic Lagers (and even then, only in major tourist cities, and at terrific prices). Everywhere else it was—and still mostly is—Chang or Singha. Both are generally served over ice to combat the omnipresent heat of Thailand, and probably also because both get worse as they warm up, resulting in sweet-but-sour, watery, grimace-inducing solutions.

The high cost of doing business in Thailand has undoubtedly been the main barrier to importing beer brands willing to compete with the nation’s duopoly. Thailand has strong import tax and duty laws. These, according to the government, protect the country’s economy from being overrun by imported products. Unfortunately, they have also created an environment where poor-quality products are affordable, but the cost of anything a little different or a little better goes up in multiples. This is true whether it’s a bottle of good beer, a pair of decent shoes, or an English-language book.

This price gap has also created a fetish for imported goods, from tools to electronics. The laws in place to supposedly protect the Thai economy have had the effect, over the years, of making anything manufactured in Thailand synonymous with low quality—and of making the desire for imports so strong that the counterfeit market has been booming for decades.

Thaopipob Linjittkorn, or Thao as he is more popularly known, a lawyer and homebrewer, was very publicly arrested in 2017 for making beer. He used that publicity to win an election to Parliament in 2019, along with 80 other members of the Future Forward Party. This progressive, pro-democracy party included in its platform a detailed plan to deregulate the beer industry, as well as a proposal for the legalization of marijuana, citing both as ways of putting money into the pockets of small businesses and local farmers.

After gaining massive support, especially from younger voters, the party was ordered to dissolve by the Constitutional Court earlier this year, and its leaders banned from running for public office for 10 years. The reported reason for the ban was an illegal loan, though most people agree it was punishment laid out by the sitting government for daring to take up such causes as the deregulation of brewing.

The opposition that Future Forward was up against is a military-backed, hardline government that supports the duopoly with strict regulations that allow it to control over 99% of Thailand’s estimated 180 billion baht ($5.8 billion) beer industry. The duopoly was originally made untouchable with the first Thai Liquor Control Act in 1950, a law which has been amended several times since to push legality even further out of reach of any small brewer.

The Liquor Control Act was amended most recently in 2017, when the craft beer movement was gaining momentum and visibility through social and traditional media outlets following Thao’s arrest. This new iteration of the act created two tiers of licensing. For small breweries, it requires production of at least 100,000 liters (852 barrels) but no greater than 1,000,000 liters (8,520 BBLs), and stipulates that all beer must be sold on the premises. At the same time, the minimum amount for an industrial license was increased from one million liters to 10 million liters (85,200 BBLs) per year, as well as requiring that the brewer demonstrate available capital of at least 10 million baht ($320,000).

Just to make sure small brewers were thoroughly intimidated, the rewrite also increased inflated penalties. Fines were increased from their original, almost quaint 200 baht ($6) for possession of bootleg alcohol to 10,000 ($300). For actually brewing without a license, fines were increased from 5,000 baht ($150) to a range of 50,000–100,000 baht ($1,600–$3,200), plus jail time. Reporting in 2017, The Bangkok Post estimated that in order to meet the new regulations, a brewer would need to have a billion baht—around $30 million—in start-up capital.

The original Thai Liquor Control Act was first established by the architect of modern Thailand, Phibul Songgram. Known historically as Phibul, the dictator, prime minister, and field marshal led several coups, revered Mussolini, and embraced fascist ideology while leading Thailand through World War II as a supporter of the Axis powers. Phibul’s influence on Thai society is still evident today, in everything from mandatory student haircuts to the way people eat.

“The fact is only the ultra rich are allowed to brew and sell beer in Thailand, and they are protected by the government,” Thaopipob Linjittkorn told The Bangkok Post in 2017.

It was no surprise to those who follow Thai politics that the current government would take drastic actions to protect the beer duopoly. Prime Minister and junta leader Prayut Chan-o-cha— who took control of the country in a 2014 military coup and was subsequently voted into office in 2016 in what international observers called dubious circumstances—is an avid admirer of Phibul Songgram. His administration has done much to reinforce the isolationist and nationalistic policies that Phibul established in the 1940s and ’50s, and has called again and again for citizens to display a certain level of “Thainess,” which the PM defines in part as unquestioning loyalty to the government.

Among those key to the opening of the MITR brewing center is grassroots activist Wichit Saiklo, known as P Chit to his many friends and the hundreds who have visited his home bar and brewing center on the nearby island of Koh Kret. P Chit might seem like an unlikely mover and shaker, being a full colonel in the Thai Army as well as the manager of two IT firms, but if the Thai beer movement has a standout celebrity, it’s him. For over a decade, P Chit has been making and selling his own Chit Beer from the small bar he runs out of his house on weekends, while also bringing many into the craft beer fold with his brewing classes.

“I never liked the taste of beer until I visited P Chit’s bar. Three weeks later I came to his brewing class. I’ve been making about five liters a week since,” says Kana, one of the 44 affiliated small brewers at MITR.

Still wearing the regulation army flattop and looking battle-fit in his mid-fifties, P Chit was quoted in a 2015 Bangkok Post article as saying “that it was fun being part of the resistance ... but one day it will get uncomfortable.” He has talked about 2020 being the target year for legal change in several interviews since. The longtime brewer helped organize the collective to start MITR in order to come into compliance with the 100,000-liters-per-year regulation for microbreweries stipulated in the 2017 law.

“There’s no way any one or even two of us small brewers would make the legal limit, but working together and gathering our many affiliates to brew here as well, we can meet the minimum requirement. We still can’t sell our beers outside, but this is a step forward,” says the owner of Sand Port Brewing, one of the six brewers at the core of MITR, who preferred his name be left out of print.

“We have four mandates that work towards legitimizing, legalizing, and promoting craft beer in Thailand, and one of them is brew in an environment that meets international standards,” says P Chit. “PM Chan-o-cha commented that microbrews are unsafe and might be brewed in a toilet. I invite him to come and inspect our premises.”

The brewing room on the night of the grand opening was closed to the public, but inside, the space was immaculate: lined with gleaming stainless-steel tubs and tanks, it featured neatly organized tables laid out with brewers’ utensils and stacks of sanitized, food-safe buckets.

Another of MITR’s mandates is to show that the craft beer industry—which Thao estimates has the growth potential of 20 billion baht ($633 million) yearly—would directly benefit small companies, local farmers, millers, and importers. “We want all those brewing in Vietnam to be able to brew here and keep the money at home,” Thao says.

What Thao is referring to is the fact that, to get around Thailand’s strict regulations, most of the 200 “Thai” craft beer brands are actually brewed outside of the country. “Thai” beers are currently made in Cambodia, Laos, Taiwan, and even Australia, but Vietnam far and away brews the most. Vietnam has no such limiting regulations on brewing and is more open to foreigners creating businesses than Thailand. As a result, it has an extensive brewing and distribution network.

In Ho Chi Minh City, Heart of Darkness Brewery has contracts with a number of Thai craft beer brands. Englishman John Pemberton first started homebrewing as a hobby while living in New York City, and continued when he moved to China out of necessity since, he says, he couldn’t find any good beer at the time. He opened his brewery and taproom in Vietnam in 2013.

There was no plan to provide brewing services for other brands when he opened, but Pemberton was soon approached by Thai-based brewers who came looking for a way around the laws keeping them out of business. With the capacity to brew batches as small as 1,000 liters (8.52 BBLs), Heart of Darkness soon found itself overwhelmed with offers from Thailand.

Other breweries in Vietnam followed suit, collaborating with Thai brewers and then shipping the beer to Thailand in refrigerated trucks. The product can go from packaging to the final point of sale and into the glass of a thirsty patron in Bangkok or Phuket over just a couple of days. But in the end, it’s the consumer who pays for all this rigmarole.

And the cost ain’t cheap. By law, these “Thai” beers are imported, and are therefore still subject to the country’s draconian import duties. In any of Bangkok’s specialty craft beer bars, “Thai” brands cost almost as much as their cousins from outside the ASEAN (Association of Southeast Asian Nations) sphere.

Import tax is calculated through a complex comparison of market values and exchange rates, as well as the opinions and future speculation of individual excise agents. The process is so complicated that, of the three beer importers I questioned about the laws, none would even try to explain them, admitting that they themselves little understood the system. Even the government’s own guidelines sum them up with what seems like a wink and a nod, ending with the sentence “whichever of both gives the highest amount of duties, will be the rate applied.”

Add to this an excise tax that varies from 1% to 50%, a value-added tax (VAT) of 7%, and the fact that “imported alcohol is also subjected to local taxes, Thai health taxes and TV (advertising) taxes, respectively amounting to 10%, 2% and 1.5% on top of the excise tax. The import duties, excise taxes, and VAT cumulated, the tax burden on most imported spirits is approximately 400 percent,” as surmised by The Nation, one of the two English language newspapers in Thailand, covering the 2017 law changes.

“This is why we have to change the capacity laws. Our mission statement at MITR is to create a unique market for Thai craft beer that meets international standards,” says Leo Bernerand, a Belgian who brews at MITR as one of the collective’s 44 affiliates. “This is to satisfy concerns about health and safety, but also to support and grow local industry while educating the public and promoting a healthier and of course high-quality product.”

It shouldn’t be too difficult to imagine a near future when craft beer is both readily available and affordable throughout Thailand. It wasn’t that long ago that it was almost impossible in the U.S., now awash in craft, to find anything but Miller or Bud and the like. Jim Koch of Samuel Adams has said that, when he started selling beer out of his home, people didn’t know what to make of it: all they knew was fizzy, watered-down beer that came in aluminum cans, so that’s all they would buy.

It seems like an easy comparison, but the craft beer movement in Thailand is different. It’s not only about education and convincing the masses that there is more to beer than skunky Lager: it’s about a much more vital change. Change that the hardline government and the 1% “terrible rich” will do anything to keep from happening.

To protect the beer duopoly is to protect an economic model that has been in place for almost a century, serving the rich and empowered while keeping the majority poor, uneducated, and working in the fields. The system that requires craft bars to charge upwards of $20 for a decent pint of beer is the same system that keeps good-quality products out of the hands of everyday Thai citizens through tax and duty, even when the products are made in Thailand.

The Thai beer duopoly has undoubtedly heard this call for change, and both companies have made attempts to placate it by putting out their own “craft” options. Boon Rawd, the maker of Singha, has been slightly more successful than Chang, offering a wannabe White Beer and a so-called Hoppy Ale. Each is slightly better than the brewery’s flagship Lager, but they still taste like unsatisfying facsimiles—like McDonald’s cheeseburgers, or French rock ‘n’ roll—when compared to the real thing.

None of these beers have managed to catch on with any great deal of success, though they are priced only a bit higher than their sibling Lagers. Those who can afford craft beer will pay for the real thing, and those who can’t or simply don’t care about the beer they drink won't bother to try them.

Craft beer is ultimately part of a greater, grassroots movement pushing to finally end the country’s string of interchangeable corrupt governments, which have replaced each other once every five or so years in a string of coups that goes back to the foundation of modern Thailand in the 1930s. While the avant garde of brewing may be in the hands of middle-aged men, the newcomers and consumers skew younger and more diverse.

In the craft beer bars of Bangkok, it’s the nuevo middle class, the thirtysomethings, who mostly fill the seats and are paying for those expensive imports from around the world. Local craft beers are found for sale wherever new trends have taken root: alternative music shows; skate and wakeboarding events; and among the new generation of runners, cyclists and rock climbers around the country. Wherever Thai people are exploring outside of the stifling cultural norms still heralded by the government and reinforced by the media is where you're likely to find a few bottles of Lemongrass Honey Ale or a Spicy Mango IPA.

I have lived for almost 20 years in the small city of Kanchanaburi, where there are just a couple of craft beer options. The local liquor store keeps a rotating stock of a few brands and one or two bars offer several “Thai” import choices. But there is one microbrewery, just on the tourist side of the world-famous River Kwai, which keeps its doors open, even with very few customers. Called 90s Craft, it has five beers on tap—five beers that its owner P Pop illegally brews at a secret location in another province.

P Pop, who maintains a hipster’s handlebar mustache and wears a full-length, old-timey apron behind his bar, laughs when I suggest that he might get raided sometime, joking that even his customers can’t find the bar, so how will the police? He agrees that deregulation would be a great thing, but even if and when it happens he won’t have the money to meet whatever new regulations are passed. He’ll continue to brew on the down-low and keep his place under the radar.

“I'm not waiting for change,” P Pop says. “I want to make beer, and as long as I can sell a little of it, I will.”

Other homebrewers not willing to wait for change have organized pop-up beer festivals. Like flash mobs, the locations of these underground events are kept secret until the last moment and then digitally shared with group members only. Brewers show up with samples of their beer along with homemade swag. They taste and compare each other’s beers for an hour or so and then all disappear back to where they came from, long before the police can organize any kind of crackdown.

It’s this willingness to break the unjust laws as much as the movement to deregulate them that is going to continue to make craft beer more and more popular in Thailand, and along the way promote more economic opportunity and equality.

It’s around 11:30 p.m. when they announce last call at MITR. The bar is still three-quarters full and a long line forms to get that final beer in. There’s a general midnight cutoff for selling alcohol in Thailand, with a few licensing exceptions for clubs in designated “nightlife zones,” one of a series of bizarre laws controlling the sale of alcohol created by former prime minister (and current international fugitive) Thaksin Shinawatra while he was in office.

The rain has stopped, but if anything the croaking chorus of frogs out in the night has increased. There is a lot of back-slapping and taking of farewell photos going on in and around the freshly inaugurated microbrewery. Well-wishers surround P Chit to wish him good luck, so I decide to take the opportunity to ask him about his prediction for this being a year of deregulation.

“I am still confident that 2020 is the year of change for Thai beer brewing,” he says. He explains that he and the other brewers at MITR have paved a smoother path for the next generation. “It took me four years to get the brewery license, but if I want to do the next one it might take nine to 12 months at most.”

From four years to 12 months, perhaps to two months or fewer in the future: 2020 does look like a year of change in Thailand. The extended COVID lockdown and shuttering of the country to tourists is having a devastating effect on the small-business economy, spurring on student protests against the Chan-o-cha-led government. These now-weekly protests are always a sign of unrest to come in a country where the coup d’état practically defines its politics.

The right for people to brew and sell beer might seem far from the kind of issue that leads to regime change. But the deregulation of the Thai beer duopoly could be a meaningful step towards something bigger: progressive national leadership and a greater sense of equality, both in the government and the economy.