This isn’t a story about a hop farm — or at least, it’s not just about a hop farm. I’m certainly going to show you how beautiful a first harvest can be on one of the world’s largest pieces of acreage devoted to the cultivation of hops. But I’m mostly going to talk about how it barely exits at all, what that might mean for the future of craft beer in America, and how Goose Island, the brewery that some fans feared was lost forever, might be in a better position to survive a potential hop crisis than almost any other brewery in the country right now.

The agricultural side of beer has always been beautiful, if somewhat niche. Hops have been cultivated in the US since the 19th century, starting in New York and then shifting to the west coast after a disease all but wiped out production. But much like their European counterparts, the industrialization of hops only went so far. It remains, despite some technological and scientific advancements, largely labor-intensive and highly-skilled. It takes continuity, knowledge, and connections with brewers to grow a successful hop program — which is as true for small producers as it is for the world’s largest.

The arrival dinner on the farm with Brett Porter and company

Roderick Read welcomes us to camp. After dinner, the crew from Santé in Spokane starts breaking down a full elk for the next day's meals

So this is a story about how the future of beer is about to get stranger than ever — and how a brewery like Goose Island might be instigating a shift in how hops are produced for a craft brewer with national scale. But they'll have to wake beer's sleeping giant to do it.

“At our lowest point, we were down to 70 acres of hops," says plant manager, Ed Atkins, who’s been with the farm since it first planted in 1987. By the late 90s through the early 2000s, Anheuser-Busch had created a massive stock of cold-stored hops. In response, they decided to strategically reduce their stores and slow the pace of hop farming. Under the Busch Agricultural Resources business, Elk Mountain had become the largest contiguous hop farm in the world. But at 1,700 acres, it still only represented about 15% of AB’s overall need. The rest they get on the open market, competing with other brewers for access to the world’s best and most abundant hops, typically targeting high-alpha acid hops that provide basic bitterness instead of the “flavor” or aromatic hops craft brewers tend to seek out.

An early morning rise at camp

First harvest begins

Over 40 varieties on 1,700 acres

Goose Island's brewmaster, Brett Porter inspects the combine

“There’s a lot of risk in hops. A flood, like we had here once. Disease. Market conditions shifting. It’s not an easy business to be in,” explains Ralph Judd, Anheuser-Busch’s Director of Raw Materials. Indeed, much like the US imports oil from other countries, despite drilling, refining, and sometimes exporting our own, the market can create efficiencies and cost-effectiveness in strange ways. It’s easier for a brewing giant like AB to use their market strength to pressure hop farmers all over the world into increase their yields, lowering their prices, and formulating for higher alpha acids (bittering acids) than it would ever be to grow their own. Vertical integration isn’t always a benefit when you’re at the scale of a global brewer.

“There’s a lot of risk in hops. A flood, like we had here once. Disease. Market conditions shifting. It’s not an easy business to be in.”

All that fluctuation made Elk Mountain less of a strategic reserve, and more of a luxury for a company counting every bean it had after the InBev buyout in 2008. In the meantime, American consumers became obsessed with hops, and varieties like Citra became a household name. Almost immediately, innovative hops became scarce and craft brewers had to contract with farmers, or reformulate their recipes, in order to producer the beers by which they had made their names. And for AB, it meant that new beers had to work within the constraints and availability of resources they already had access to. A national IPA with a discernible amarillo hop profile, for example, would be nearly impossible without devastating the market.

Plant Manager, Ed Atkins and his team provide an overview of the hop processing machinery

All this time, Elk Mountain remained nearly dormant. “We were hop farmers, but instead, we were growing canola and wheat under all these trellises,” recalls Atkins as he looks out over the years harvest. He has the look of a man that’s grateful for a sudden change of fortune. “That’s tough for a hop farmer. We’re not wired for that. We were starting to wonder what the future held for us here.” Just as it seemed like the farm was losing its relevance as an agricultural resource in the AB business, the 2012 acquisition of Goose Island was taking place over 1,800 miles east in Chicago.

As the first major craft brewery acquisition in AB’s portfolio, it wasn’t clear what such a move would mean for the overall business. Clearly AB wanted to compete in the craft sector, which was becoming critical as craft’s overall share crested the 10% mark. Many drinkers familiar with the Goose brand were highly skeptical of the small urban brewery's future resting in the hands of the largest corporate brewer in history. Other local fans were cautiously optimistic as most of their favorite beers, such Bourbon County Stout and the Vintage Collection continued uninterrupted, and actually grew in the market. But there was also a major loss of talent in the years following. “Last year was definitely the hardest,” recalls lead brewer Keith Gabbet. “It was hard to lose so many great people. But I hate quitting. I hate giving up on things when I think there’s a chance to make them better. And I saw that chance here.”

Top right, Goose CEO Andy Goeler gets gothic

Gabbet, who started as a weekend brewer and worked his way up, remembers the day he heard about Goose being sold to AB: “I was pretty freaked out. But I decided to take a wait-and-see attitude.” He worked alongside the newly-appointed brewmaster Brett Porter and others to lobby for long-overdue improvements in the brewery’s operations that simply didn’t have the capital behind them until AB bought the brewery. Since then, he’s been happy to see better equipment, more space for barrel-aging, and brands like 312 roll out nationally. “Brett is pretty great at fighting for things he wants,” explains Gabbet. “It felt like my voice was being heard for the first time in awhile.” Shortly after, Gabbet made his first trip to Elk Mountain — “Ed and John were thrilled to have us here.”

Gabbet isn’t worried about talent leaving anymore, in fact, talent is starting to knock on Goose’s door instead. They recently signed on experienced brewers from Flossmoor Station, New Holland, and most recently Quinn Fuechsl from Sun King. Gabbet thinks he knows why they’re coming to Goose: “I think these guys see a chance to brew great beer, not just work themselves to death. We're not just a stop on the way to a career in brewing anymore."

The kilning begins as hops are spread over a mesh floor and slowly heated

A portrait of the hop baler as an old man

So when the time came to start creating new recipes at Goose Island for the national market, there was a bit of a learning curve for AB’s resource managers. “Brett asked if he could have some of our Cascade,” recalls Pete Kraemer, VP of Supply and AB’s brewmaster. “Next time I came back, he had taken all of it. I didn't have enough to make Bud Light!” It was impossible to satiate the Goose brewing team’s desire for hops, and that meant that AB was either going to find what they needed on the open market — competing with every other craft brewer — or find a way to start growing their own again as a strategic resource.

“AB buying Goose Island is what made this place important again,” explains Atkins. The team grows 40-50 hop varietals on Elk Mountain now — hops that are going into beers like Ten Hills pale ale, Endless Summer IPA, and the now-releasing Rambler IPA. It takes an incredible amount of specialty hops to make these beers stand apart at Goose's new national scale. But the other side of directly managing this resource is that it means AB is also able to apply its deep analytical capabilities on the hop chemistry, R&D brewing, and agricultural side to ensure a highly-competitive position for Goose, and eventually their newest acquisition, Blue Point in Long Island. The knowledge that’s being generated here is astounding as they look for ways to breed for disease resistance, alpha acid production, and new-to-the-world varietals.

“AB buying Goose Island is what made this place important again.”

Only time will tell if all that science will do the industry good. Many newer hop varieties, such as Citra, Simcoe, Mosaic and Warrior remain proprietary, their names registered as trademarks and their genetic profile closely guarded by organizations like Hop Breeding Company and Select Botanicals Group that put in the time and effort to create them. After these hop’s gain relevance, the market often shifts quickly and resources become scarce. In response to these ripple effects, many breweries like Three Floyds, have ceased listing hop profiles for their beers, avoiding criticism when they’re forced to change their recipes, and likely calming the waters for fast-follower breweries who simply try to make a Zombie Dust clone.

Spliced root stock makes it possible to have an all-female farm to produce buds

New acreage is wired

Last year, AB sold their extra Amarillo production from Elk Mountain into the general market, creating a bit of a temporary windfall for eager brewers around the country. But that’s unlikely to last as Goose ramps up production, Blue Point comes on-line, and AB’s own in-house brands start to get more adventurous. There simply isn’t enough acreage in the US to support the growth of craft beer, and that will only get worse as larger brewers start positioning their products to compete on hop flavor and aroma as well. Small producers should count themselves lucky that the two most popular craft styles from MillerCoors and AB are still Belgian wheat beers and not a hop-forward style.

“Hop farming is still a niche industry,” says Stan Hieronymus, who quite literally wrote the book on hops. “You have 1,700 acres here, about 3,000 total at Kent when you count all the farms. It’s not a lot of land devoted to hops.” At the Craft Brewers Conference in 2008, a brewer asked Hieronymus why there was no futures market for hops, given the rise in demand and limited resources. To put things in perspective for the brewer, Hieronymus compared global hop production to soybeans in Champaign County, Illinois, where he grew up. "In 2013, Champaign County farmers grew 12,774 bushels of soybeans on 243,000 acres. Total worldwide hop acres in 2013 equals just 114,227 acres!"

According to the brewers’ association, craft beer aims to double its market share by 2020, which will require at least a doubling of hop acreage to accommodate the beers they want to make. But to-date, small, regional hop-farming is still unproven from both an agricultural and economic perspective. Hops are being grown in new areas all over the country, from Michigan to Virginia, creating new connections between farmers and brewers, but the resources and expertise required to start up are a major barrier, and the resulting prices make it difficult for small breweries to support these farmers with more than an occasional specialty beer. It’s hard to justify paying 2-4 times or more for hops when the average consumer doesn’t want to pay more that $6 for an IPA.

Skilled labor is the most critical resource for Elk Mountain come harvest time. For just a few months out of the year, Elk Mountain relies on well over 100 migrant farmers, some who have returned for generations, to pick, kiln, bale and transport the hops from northern Idaho to Yakima Valley for processing and cold storage. It’s an intense operation during that time, often running 24hrs a day to bring in the harvest on time. Workers live on-site in barracks with the families, sending the kids to school in nearby Bonners Ferry, Idaho, about 20 miles south of the Canadian border. While migrant farming in the US has historically been exploitative, the modern market creates leverage for workers in a competitive harvest season. “We’re hoping for 120, maybe 140 workers this year,” explains John Solt, a manager at the farm. “But it’s tough. If we can’t provide them with the work and the amenities they want, we lose them to other farmers just like that.” (snaps his fingers).

Some workers are invaluable to the delicate and highly-specialized operation of hop farming. “Our kiln operators are the highest paid on the farm,” explains Atkins. Our main dryer has been coming here for 26 years now. He knows everything there is to know about how theses kilns work, where the wet spots are, where the hot spots are. We use new thermal imaging tools now too, but he can pick hops up with his hands and know how far along they are.”

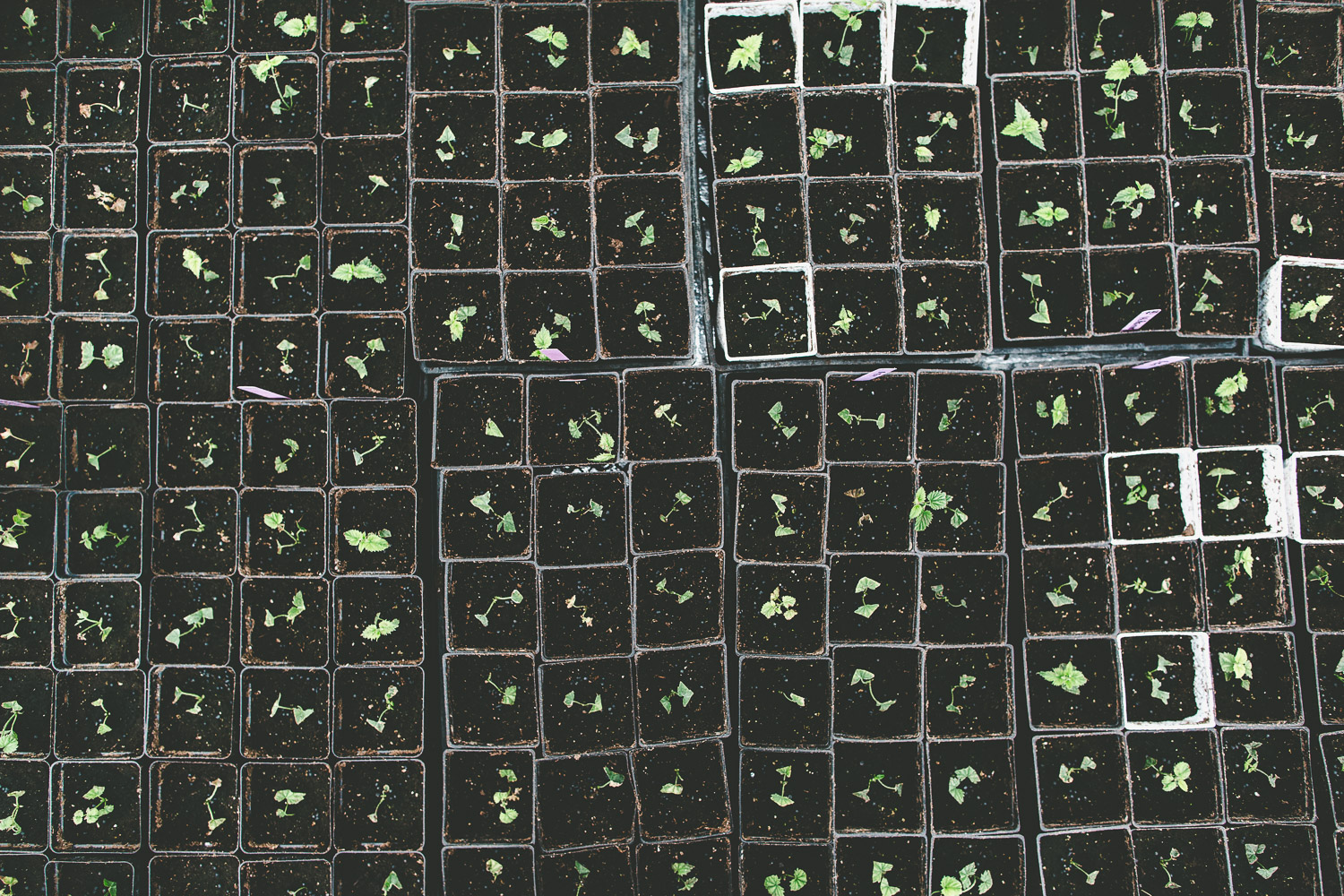

With such a verdant landscape and intensive operation on display, it’s hard to imagine Elk Mountain lying dormant. But it was only a few years ago that Atkins and company had to replant the entire farm and nurture it back to life. To do that, they had to breed the female rhizomes in small greenhouses on-site, turning a few dozen “babies” into over 100,000 in a single generation. The process of planting the small stems that morph into root structures is somewhat unique to hops, making it possible to accelerate their replication even without male plants, which contain seeds. “The seeds complicate the picking process,” explains Atkins. “We just want the females. So we manually pluck any males we find, which can infiltrate with pollen from as far away as Yakima. You can’t tell me there’s no wild hops out there.”

Each stem structure has to be manually wound around the trellises. Because they’re technically a bine, not a vine, there are no tendrils to accomplish this on their own. “You have to wrap them around by hand in a clockwise direction. If you don’t, their natural growth angle will unravel them all over again,” Atkins observes.

There’s a lot of renewed optimism on the farm as they work their way back to full capacity with a plethora of new hop varieties. AB hop chemist, Peter Wolfe, is working with the farm to derive the right balance between alpha acids for bitterness, and the aromatics that craft brewers want. “We’ve been working to get more bittering alpha acids for so long," explains Wolfe, "that some of the other elements of hop chemistry haven’t been advanced nearly enough. We’re working to change that now.”

Companies as large as AB typically have trouble seeing beyond their own operation, and understanding what’s happening in a market as diverse as craft beer. When the lead-time on a new brand is 18-24 months, there’s little advantage in being a fast, or first-mover with new flavors and recipes — in fact, there’s a lot of risk in being too early. AB has introduced brands previously that barely trickled out of St. Louis, not because they weren’t thoughtful, progressive beers, but because the market wasn’t ready at a scale necessary for AB to put resources behind it. Goose Island, on the other hand, represents a new conduit to the market for AB’s research and development managers.

“You can’t always be first,” admits Jane Killebrew, AB’s director of brewing, quality, and innovation, “but you don’t want to be last.” Killebrew seems to have a new spark in her eye as well, after years of creating brands for AB. Her most recent success was Straw-ber-rita and Lime-a-rita — she loves it when a product nails its intended market. “It’s aways a blend of insights, brewing, and marketing,” she explains. “No one cared about the Ritas when they were in big bottles and called “mixology." But in 8-ounce cans they were unique, cute, sold in convenience stores and branded with Bud Light — it was huge.” These days, even some small craft producers are trying to make their own “Rita clones” on the back of the Radler craze that took over the Midwest the past couple years.

Often, innovation in the beer world starts top-down. Marketing identifies an opportunity to sell a product in a new way, or to new audiences, or to simply keep up with trends, and the brewing side has to create a beer that meets that need, like it did with Michelob Ultra, targeting the health-conscious 45+ crowd that simply didn’t drink much beer anymore. But working with brands like Goose Island, a lot of the conversation is reversed. You have a beer like 312, and you have to figure out how to adjust the larger system to accommodate the beer instead. “We did 20 trials of 312,” claims Killebrew. The trials involved constant tasting and debate with Brett Porter and the Goose team as AB tried to match the flavors and aromas in their Baldwinsville, New York brewery. “It’s usually way easier to invent a new brand than to try and copy an existing brand,” says Killebrew.

Lower left, chef Jeremy Hansen of Santé; top-right, Pete Kraemer, VP of Supply and AB’s brewmaster.

We spent our last afternoon dry-hopping and wet-hopping some Budweiser and Goose Island 312 Pale Ale with hops fresh-picked and kilned at the farm. You could see the immediate emotional and intellectual effects of the process on folks from St. Louis who rarely have the time or incentive to explore such hands-on, sensory-driven trials this far away from home. “We should brew a wet-hop ale!” yelled Andy Goeler, Goose’s new CEO, grinning at the AB team as they all realized the logistical challenges involved in a national roll-out of a time-sensitive process like wet-hopping. But that’s sort of the point of these kinds of experiences being driven by Goose — ideas first, problem-solving later. “That’s delicious,” said Pete Kraemer, VP of supply and head brewmaster as he swirled a 312 Pale randalled with fresh-picked Amarillo. Roderick Read, the Anheuser-Busch Research Pilot Brewery manager, and the others from St. Louis went home with ziplock bags packed with wet hops the next morning.

Goose Island's West Coast educator, Christina Perozzi

Now that innovation at AB also involves newly acquired craft brands like Goose Island and Blue Point, there seems to be a lot of eagerness to put AB’s incredible resources to work in craft beer recipe development, looking for flavor and aroma from ingredients that grow on a bine instead of in a lab. And when the process is closer to the product and the people behind it, it seemingly becomes personal again. When asked what the future held for Killebrew’s relationship with Goose Island, she excitedly proclaimed “I think we need a stout!” When asked why, she paused, and without a more technical or analytical answer coming to her in the moment, she admitted “because I really want to drink one!”

A huge thanks to the teams from Goose Island, Anheuser-Busch, rEvolution, Santé Restaurant & Charcuterie, and of course, the team at Elk Mountain for their generosity in helping make this trip possible, as well as memorable.

Michael Kiser

Michael Kiser